Many residential multifamily property investors are wondering what rent control could mean for them in the wake of the passage of Oregon Rent Control SB 608. Zoe York, MAI Appraiser with Duncan & Brown, examines the market trends and how rent control might impact the value of an under-rented residential multifamily property.

[embedyt]https://youtu.be/j3-cU8RA1iM [/embedyt]

Watch or Read

The formula for valuation using the gross rental multiplier (GRM) is quite straightforward, and the difference in GRMs when you’re using below market versus at market is noteworthy. Market trends in terms of these rent multipliers reveal that they were climbing pretty high to pre-recession levels, but a lot of those GRMs were based on in-place rent. So, for example, a GRM of 165 might be that high because you’re applying it to a below market rent.

Calculating Value in Residential Multifamily Properties

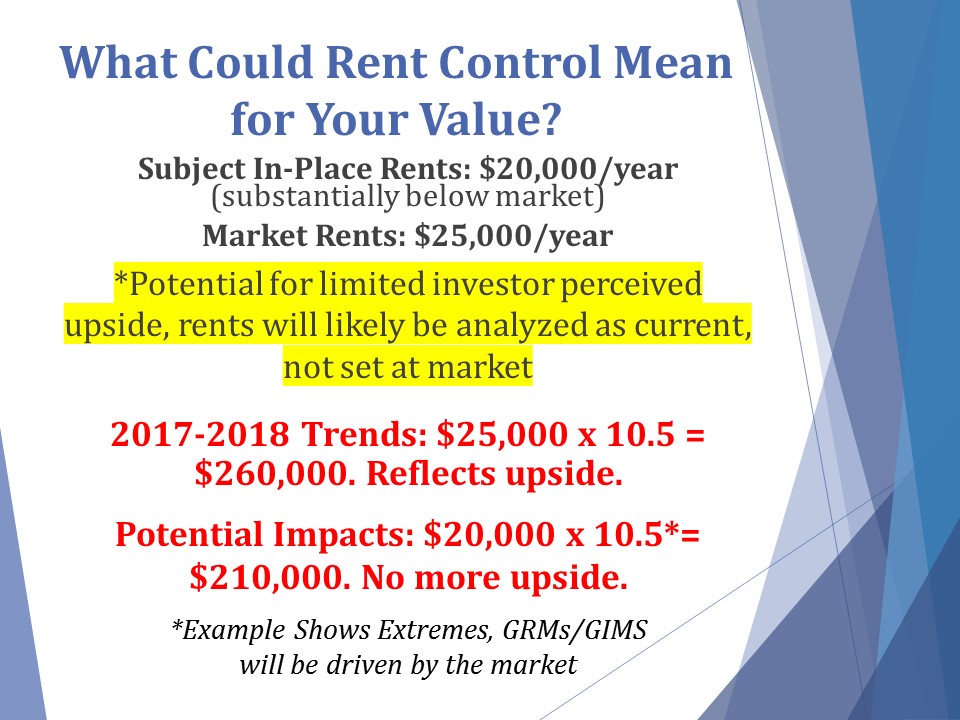

The figure displays a hypothetical example that is a bit extreme to reveal how the inputs could change the value and change the output. That doesn’t necessarily mean this is the value change you’re going to see. This just gives you a really good example of how rent control and a changing market can impact your value numerically.

For this hypothetical property, the in-place rents are $20,000 per year, which are below market because the market rents for this hypothetical property are $25,000 a year. Based on the trends that we’ve seen before rent control, we saw those really high GRMs getting applied to the market rent because they were seeing upside. As an investor, you might want to look at a duplex that’s under-rented; it’s $800 per side. You would say, “Okay. I can increase rents easily to market rents in the next couple of months or when the lease is up.” So you’re seeing perception of upside in that investment. In that case you’re going to pay a little bit higher income multiplier because there’s upside.

Looking at 2017–2018 trends, you say, “Okay. Market rent should be $25,000. I’ll apply this factor that I extracted from the market but I’m giving it some benefit of the doubt of upside, so $260,000.

“My thought is that moving forward the investor-perceived upside is no longer there. It might not be this extreme. This in an extreme example of applying the exact same gross rent multiplier (GRM) to the in-place rents.”—Zoe York

There still may be some upside, but your upside isn’t as immediate and it isn’t as dramatic because now as an investor you’re looking at the same property and you’re saying, “I’m not paying you for the $25,000. I’m going to pay you for the $20,000 because that’s what you’re getting now and that’s what I know I’m going to get and I also know that I can’t increase my rents this dramatically in one swoop.”

Again, this is the same formula—now 260 has gone to 210. Again, this is a dramatic example and everything in the market is market-driven, so these GRMs are extracted from sales and ultimately the true impact on what these GRMs and these multipliers are going to be are going to be driven by the market. They’re going to be driven by investors. They’re going to be driven by buyers and sellers.

If you need assistance with appraisal services, visit www.duncanbrown.com.

If you need assistance with appraisal services, visit www.duncanbrown.com.

If you want more information about rent control and residential multifamily properties in Springfield Eugene, visit Pacwest Commercial Real Estate’s Oregon Rent Control Central.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments