Due to the passage of Oregon Rent Control Senate Bill 608, every multifamily real estate investor in Eugene and Springfield has decisions to make. Each person must decide what works for them, but should do so with an understanding of value and trends as well as what has occurred when rent control was implemented in other localities. This will make you a savvy investor.

[embedyt]https://www.youtube.com/watch?v=xey7hX2Pbc8[/embedyt]

Watch or Read

Why Would You Consider Selling?

Why would some investors decide to sell and get out? Some people simply don’t want the government control. Other people are concerned about having kind of a target painted on them with the tenant issues and then experiencing issues defending themselves. Some want out before the local governments get involved and decide where rent control should be. In San Francisco rent control started in the range of 6 and 7 percent. They just lowered it to 1.7 percent for a cap in San Francisco. You may be thinking, “Well, what Oregon just passed isn’t too bad: seven plus consumer price index.” The CPI is 3.25, so rents are at 10.325 right now. Well, if the city of Eugene or the city of Springfield decides that they want to get involved, that could change things. I’m not saying that can happen right now, but it could potentially down the road happen. So some people have just decided, “Now’s the time I need to get out. I need to transition into something else.”

Value, Trends, and Rent Control

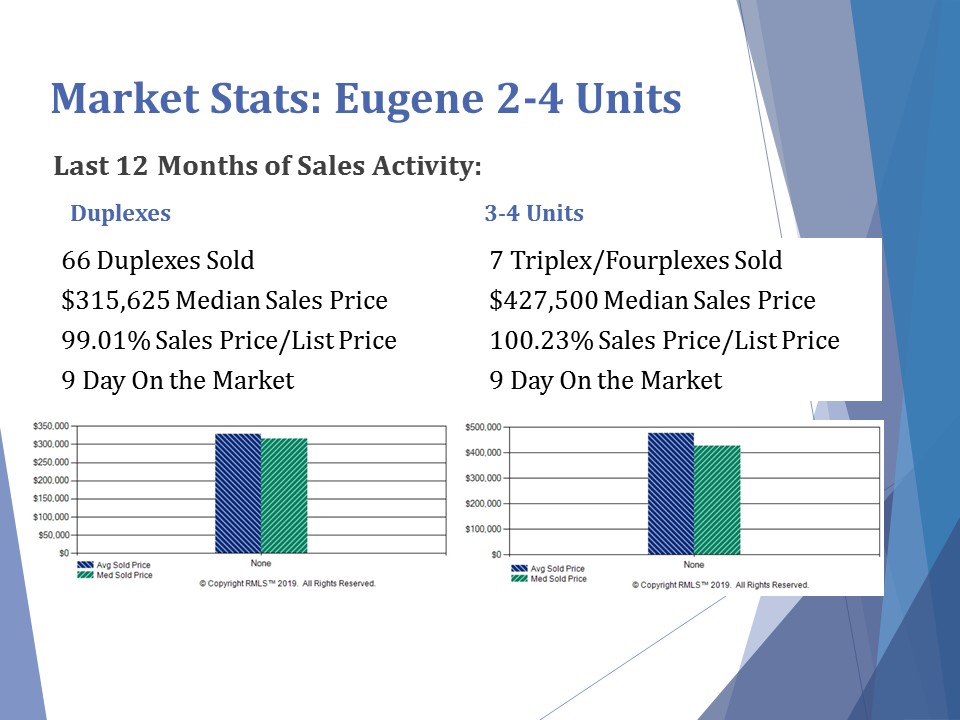

Let’s talk about market statistics, because this is an important factor. If you want to sell, you need to start thinking about value and trends and getting your properties ready. If you look at the chart displaying market stats in Eugene, it shows duplexes and three to four units that have sold in the last 12 months. In Eugene, there were 66 duplexes that sold. For duplexes, the median price was $315,000. As you can see, it sold almost at 99 percent of list price, but notice the number of days on the market: nine days. That goes really, really quick. Part of what we’re going to experience is when a buyer decides that they’re going to finance that property, most Fanny Mae interest rates can only be locked in for 60 days for a rate protection. If you now have to deal with giving a 90-day notice to a tenant, you could be in a quandary.

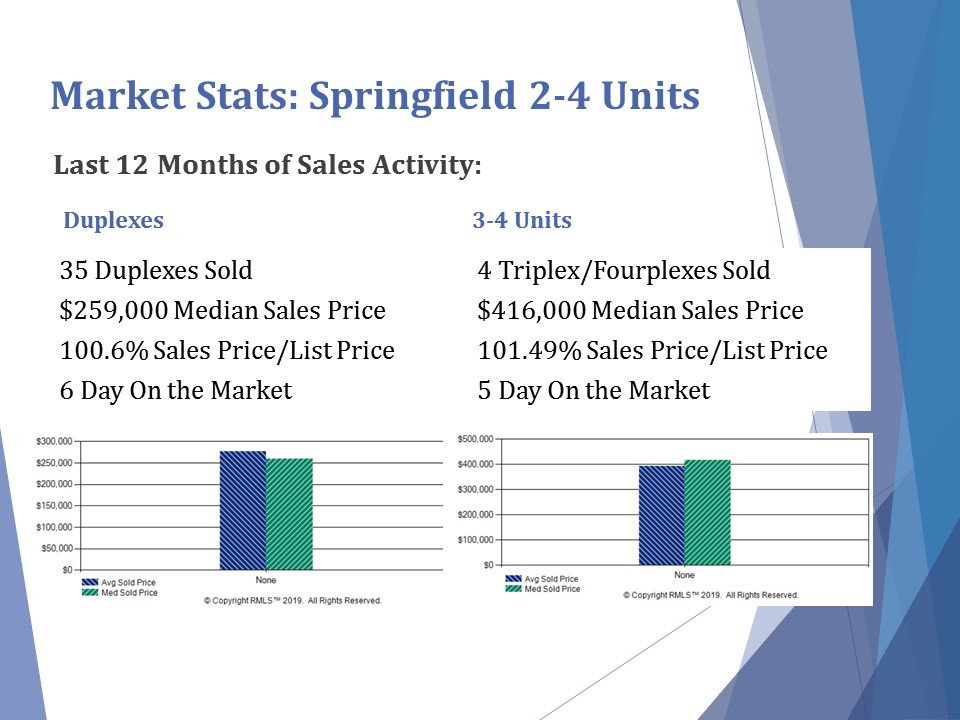

Now let’s consider getting your property ready because I deal with a lot of investors who put their property on the market. A buyer comes in and starts to do their inspections. Then you, as a seller, have to deal with potential property repairs. That can either dip into your pocket if you have deferred maintenance, or it can put you into a situation where you’re scrambling to find a contractor who can help you make the repairs. Look at the Springfield chart. As you can see, they had 35 duplexes that sold last year with a median price of $259,000. They sold a little over sales price. Typically, when it’s 100 percent plus, we they financed in either potentially repairs and/or some closing cost. Six days on the market was traditional last year, and for three to four units it was five days. Again, they go really quick once they hit the market, but you need to have a plan put together.

“No investor should have to roll the dice on their financial freedom!™” When you are considering your options, get an expert on your team: René Nelson, CCIM, (541) 912-6583.

“No investor should have to roll the dice on their financial freedom!™” When you are considering your options, get an expert on your team: René Nelson, CCIM, (541) 912-6583.

If you want more information about Oregon Rent Control SB 608, visit Pacwest Commercial Real Estate’s Oregon Rent Control Central for the latest information.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments