It’s gratifying to help investors make the most of their real estate investments and financial freedom. With the passage of Oregon Senate Bill 608, I have already received phone calls from investors wishing to transition out of their multifamily property investments. There also seems to be an effect on out-of-state investors. Understand the trends so you can make decisions that work for you.

[embedyt]https://www.youtube.com/watch?v=zyvfU8rpkrg[/embedyt]

Watch or Read

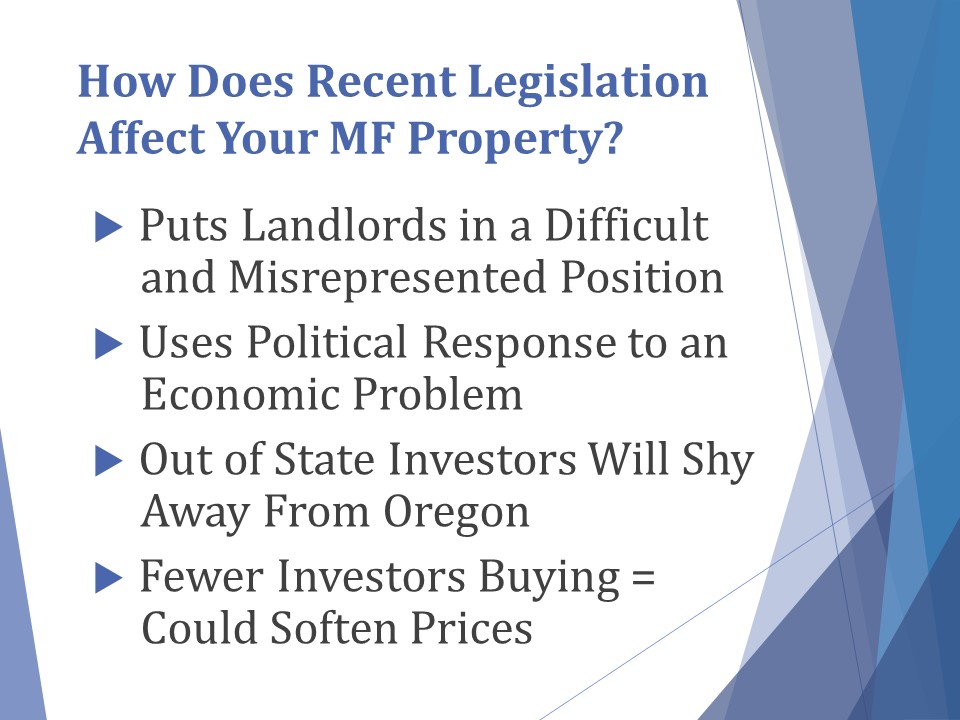

Not every multifamily investor will want to get out of the market, but there are some investors who have called me already and said, “I want to transition out. I’ve done everything that I can to get my units to the top dollar, and I just can’t put any more time and effort into them plus have the government mandate with rent control. I don’t want to deal with this anymore.”

Impact of Rent Control Oregon Senate Bill 608

Let’s examine how the legislation impacts the multifamily world. In 2017, the Portland market implemented rent control, and we saw properties put on the market for sale pretty immediately. But interestingly enough, interest rates had not started to climb. Now that the Fed has raised interest rates four different times, that is starting to make an impact, and in the Portland market, we’re starting to see property values drop pretty substantially.

The largest purchaser of multifamily properties in Portland last year was Blackstone, one of the largest real estate private entity firms in the world. For them to pay a $4,000 a relocation fee to a tenant, that’s like change in a couch to them. That’s nothing. But for those of us that manage our portfolios, who have worked really hard to pay relocation fees to a tenant, it’s expensive, and it’s painful, and you don’t want to do it. So I believe it is worth looking at some options if you want to get out of it.

Part of what I think really needs to happen is a political response to a situation that needs to be dealt with: the urban growth boundary. Rick Duncan, partner in Duncan & Brown, has been very instrumental in serving on multiple panels and boards with the City of Eugene, trying to get the urban growth boundary expanded so we can have more developers come into the Eugene Springfield area and develop. There are a lot of affordable housing opportunities where builders are trying to build affordable housing right now, but with rent control now passed, we have to deal with the cards that have been dealt to us.

I personally anticipate that out of town investors are going to shy away from Oregon for a while, because I deal with real estate on a national level, and the first thing that I hear when I talk to a broker is, “Oh, you’re from Oregon. How’s that going?” So, we are already kind of marked on map that we do have rent control, and I do believe there will be fewer investors coming into our market from out of state. In the past, the 1031 buyers would come in from California because they’d sell a property, and to them, 3.5 percent cap rate felt like a deal when they were selling their million dollar properties in California and moving into our market and buying stuff in Portland at 5.5 cap. They thought they were getting a grand deal, but now that’s changing, and we’re starting to see that transition in the Portland market trickle down; prices are starting to drop, and cap rates are going up. These are issues to be aware of.s

“No investor should have to roll the dice on their financial freedom!™” When you are considering your options, get an expert on your team: René Nelson, CCIM, (541) 912-6583.

“No investor should have to roll the dice on their financial freedom!™” When you are considering your options, get an expert on your team: René Nelson, CCIM, (541) 912-6583.

If you want more information about Oregon Rent Control SB 608, visit Pacwest Commercial Real Estate’s Oregon Rent Control Central for the latest information.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments