Rachel McLaughlin, exchange facilitator with Cascade Title Company, looks at three property identification rules for a 1031 exchange. If you are considering selling your multifamily properties due to Oregon Senate Bill 608, discover what you need to know about 1031 exchanges. You do not have to follow all three rules; you choose the one that best fits your situation.

[embedyt]https://www.youtube.com/watch?v=CFdKDTqvTNs[/embedyt]

Watch or Read

Property Identification Rules for 1031 Exchanges

The Three-property Rule

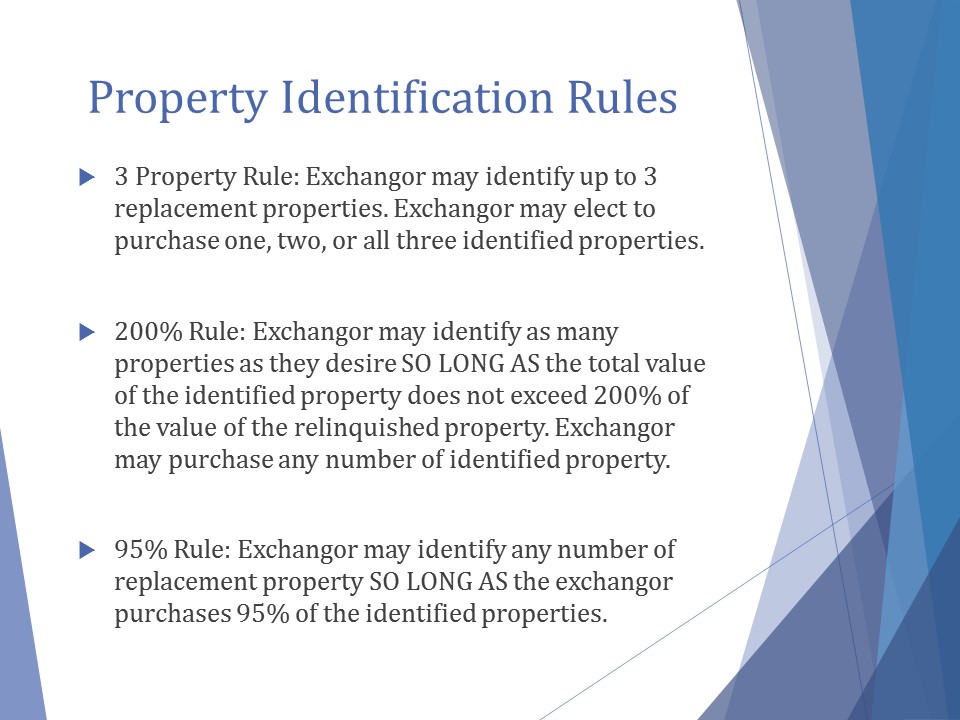

The first rule is the three-property rule, and it is the most common that my clients use. I would say 90 percent of my clients use this rule. In this rule you can identify up to three properties for your replacement properties. You do not have to identify three, but you can identify up to three, and I always recommend that you do.

You do not have to purchase all three, but the other two properties serve as backups, in case something comes up that leads you to change your mind. Perhaps you’re under contract and you get to day 46 and you get an inspection back on the property and for whatever reason you decide you can’t go through with the purchase. Either you can’t get a lender to fund it, or you don’t want to deal with the issues that came up on the inspection. At that point, if you didn’t have anything else identified, your exchange would be dead if you weren’t going to complete the purchase. You would have to decide, “Am I going to have my intermediary release these funds and I pay capital gains on those funds? Or do I purchase this property and deal with all the issues that are on the property?” But if you had two more in your back pocket, you would have some options, then, to replace the property you’ve sold.

The 200 Percent Rule

The other rule is the 200 percent rule. With this option, you can identify 200 percent of what you sold for. If you sold for $100,000, you can identify $200,000 worth of property. I had a client come in the other day and they wanted to purchase three properties, so this rule worked well for them because it gave them at least one property in their back pocket in case something came back on one of the properties and they weren’t able to go through with it.

The 95 Percent Rule

The last rule we have is the 95 percent rule, and this one is rarely used; I’ve only seen it used once. The 95 percent rule is you can identify any number of properties, but then you have to purchase 95 percent of what you identified. We had a client in San Francisco who bought really low and ended up getting to sell really high, and she wanted to do an exchange. She sold her property and then purchased six short sales across the country, it was a very difficult exchange as you can imagine, with a lot of timelines to manage, but she got it done, and she used the 95 percent rule for her identification.

If you need help with a 1031 exchange, contact Rachel McLaughlin, Exchange Facilitator.

If you need help with a 1031 exchange, contact Rachel McLaughlin, Exchange Facilitator.

Do you want to learn more? Visit Pacwest Commercial Real Estate’s Oregon Rent Control Central for the latest information.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments