If you’re starting to think about moving from multifamily properties into commercial real estate investment, it’s good to think ahead and understand the process in front of you. Understand your potential tax consequences, the value of pursuing a 1031 exchange, and the steps involved in preparing to list your multifamily property.

[embedyt]https://www.youtube.com/watch?v=PIa85E3i_gU[/embedyt]

Watch or Read

Steps for Listing a Multifamily Property

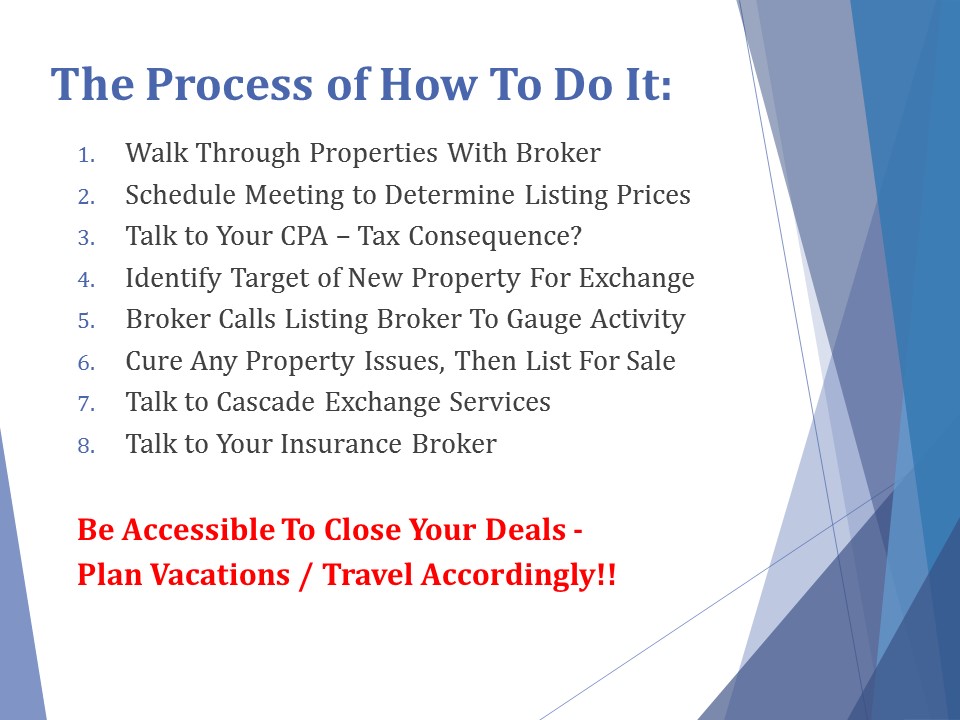

First, I recommend walking through your properties with a broker. Schedule a meeting to determine the list prices. I like to walk through the properties before I recommend the list price, and the main reason I do that is I want to see the condition. I’ve sold duplexes with green shag carpet and orange countertops. They sell. They will sell. But I’ve also walked through properties that are really nicely appointed: new countertops, new stainless steel appliances, and so forth. I just like to take a look at it and see what it looks like before I tell somebody what their value is.

Next, talk to your CPA to weigh out your tax consequence. Your CPA will know important factors like what your basis is and whether you need to and do a 1031. This is their speciality.

The next thing that you want to do is identify that target property of where you want to go and what that looks like. The process is always similar but recently I was working with a client and analyzing her portfolio to come up with a value and what she will net out of it. Now we’re trying whether she wants to invest in Oregon or go out of the state. We’re starting to look at different options, and what she’s trying to accomplish for her rate of return.

I will typically call the broker that has that property listed and ask some questions. How active has your listing been? How long has it been on the market? Have you had any good offers? What I’m trying to do is get tell signs out of that broker, do we need to jump on this or has it been on the market for three to four months and we could take our time and just add it to the list? In an exchange you can identify three properties. That’s the other reason that I like to call the broker because I want to find out if we name one of those properties on that list, we want to know if it still may be there in the event we start down the road on one property and then decide we don’t want to pursue it due to issues with it.

When you’re ready to list a property for sale, it’s good to check with your insurance broker and just say, “Hey I think I’m going to sell this property and buy a different property,” because FEMA recently changed all the flood maps and it has made a difference in what properties brokers are willing to put insurance on. They now have new requirements as well. If your insurance agent tries to tell you something that doesn’t feel right, shop around.

Last year, I had a six-plex in the campus area, two story, built in 1905. There are a lot of those in the campus area. I had an insurance broker tell the buyer that he had to build a set of stairs from the second story window, but it was a little postage-sized lot and there was no way that the city was going to allow us to build a set of stairs out the second story window—so he shopped insurance agents and found out that there were other options. Underwriting requirements are changing right now, so if something sounds strange, ask questions and shop around.

Accessibility for a 1031 Exchange

Regarding the process if you decide to sell a property and do an exchange, be accessible. I’ve had clients before to sell a property, and then go out of the country. After you close on the property that you’re selling, you only have 45 days to identify what you’re going into for your exchange. If you’re out of the country for 25 of those days, you’ve just lost a big window of opportunity. And if we can’t find your replacement property, you could potentially pay the tax. Be accessible, and make your travel plans accordingly.

“No investor should have to roll the dice on their financial freedom!™” When you are considering your options, get an expert on your team: René Nelson, CCIM, (541) 912-6583.

“No investor should have to roll the dice on their financial freedom!™” When you are considering your options, get an expert on your team: René Nelson, CCIM, (541) 912-6583.

If you want more information about Oregon Rent Control SB 608, visit Pacwest Commercial Real Estate’s Oregon Rent Control Central for the latest information.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments